With the recent U.S. Supreme Court decision upholding the constitutionality of the the Patient Protection and Affordable Care Act, and the ensuing uproar around the dangers of a “new type of tax”, I’ve been thinking a bit recently about the maximum sustainable tax rate for a given country. So I started to do some digging, and what I found was (at least to me) very surprising.

U.S. Tax Complexity

It will come as absolutely no shock to any American that U.S. taxes are preposterously complex. So much so that it’s nearly impossible to figure out what one actually pays in taxes oneself, let alone what an average tax might be. I’m not just talking about the complexity of Federal tax returns — which indeed can be ridiculously complex on their own. But then consider that 43 states and the District of Columbia each impose an income tax. There’s an additional income tax in many municipalities. Add to that sales tax (45 states) and property tax, which also vary by municipality (roughly 88,000) and one starts to see how truly complex taxes in America are. But that’s just getting started. There are inheritance and estate taxes. Depending on what one consumes, there are taxes on vehicles, cigarettes, alcohol, etc…, etc…. And then there’s the implied burden of corporate taxes, which get passed along as a truly invisible cost to consumers.

This results in tremendously wide disparities in taxes, depending upon where and how one lives. Do you drive a car? Do you buy a new one every 4 years? Let’s say it’s a $27,000 car bought new, weighing 3,522 pounds; a four-door, six-passanger car, with an eight-cylander engine. Why does one have to specify that? Because different states and municipalities tax differently — some on gross vehicle weight, some on value, some on class of vehicle, or some combination of all of those things. If you bought that car, you wouldn’t pay any tax at time of purchase in Alaska, Montana, New Hampshire, or Oregon. But you’d pay $1,953 in combined sales and excise taxes in Indiana, New Jersey, Tennessee, Rhode Island, and the District of Columbia. But then every year you have to register that car, and registration fees would vary from $8/year in Arizona to $217/year in Montana. Oh, and then you’d presumably want to drive it. Motor fuel tax rates range from $0.08/gallon in Alaska to $0.461 in California.

So, it depends on where you live and how much you drive, but you could easily be spending a few thousand dollars a year in taxes just to be driving. Do you smoke a pack a day of cigarettes? You’re taxed $62/year for that in Missouri, and $1,262.90 in Rhode Island. Taxes on hard liquor range from $1.50/gallon in Maryland to $12.80 in Alaska. You don’t drink the hard stuff, you say? OK. For beer you’re paying $0.02/gallon in Wyoming, but up to $1.07 in Alaska.

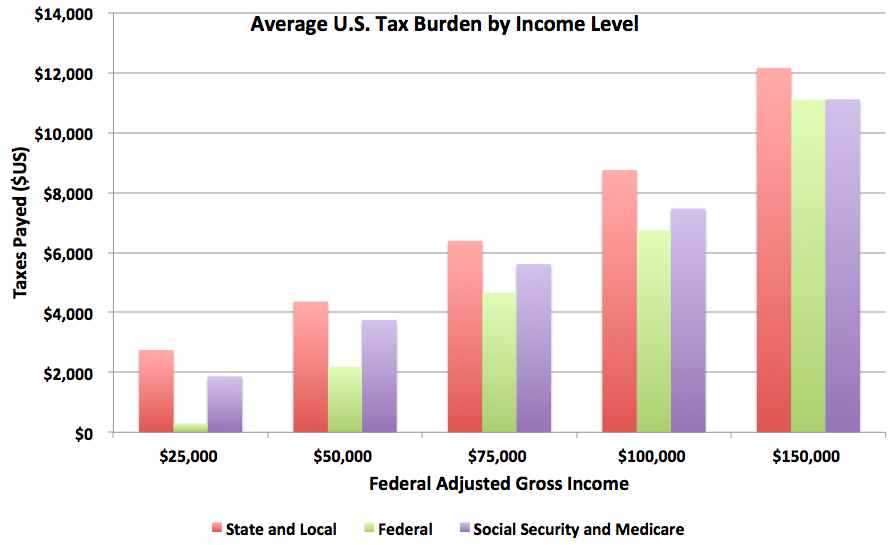

So just how much are Americans paying in taxes? The below chart shows how the tax burden would be broken down for a hypothetical family of four in 2009, with a total income of $50,000.

Tax Trends

Once one gets past the inherent complexity of the U.S. tax base and has some reasonable figures, it’s possible to start looking at trends. The first place I chose to look was at the aggregate data and compare across income levels. This next chart summarizes exactly that.

It’s not surprising at all that the more money you make, the more you pay in taxes across all categories. The items that I find interesting in this cut of the data are to do with local (state and municipal) taxes. If you watch the news and listen to the public debates, you would think that the Federal government is taxing the middle class to death. However, the reality of the situation is that across all income levels, local taxes exceed Federal taxes. Equally poignant is the distribution of tax at the $25,000 income level. Thinking about a family of four at that income level I’m both impressed with how low the Federal tax is, and shocked at what a substantial part of the family’s income would be devoted to local taxes.

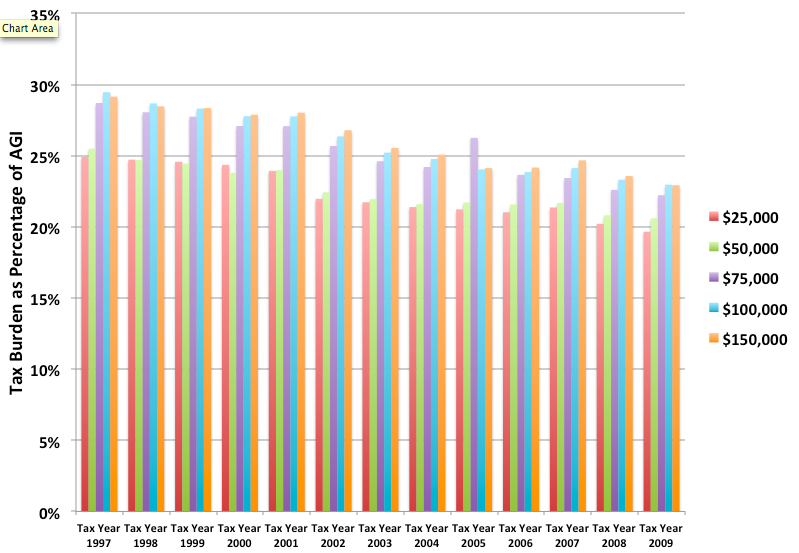

Once I’d gone through the trouble of locating all this data, I thought it might be worth looking at it in another way: across time. Once again, I had some surprises in store.

We hear debates about the criticality of extending the currently temporary tax cuts, and perhaps extending those cuts is, in fact, critical. But those cuts were Federal actions. When you combine social security, Federal income, and state and local income, property, and auto taxes you can get a picture of the total tax burden. And that total tax burden, again, at every income level, has been slowly yet steadily, year over year consistently decreasing for over a decade. Perhaps it’s just me. Perhaps everyone else in the U.S. knows that they’re paying less in tax than they were last year, and a lot less than they were a decade ago. But for me, I have to say this came as a surprise. I don’t feel it viscerally. And it certainly isn’t something that is regularly discussed in the news.

But that wasn’t the end of the surprises for me. What happens if we rotate this chart? That is to say, what does it look like if instead of comparing taxes by year at each income level, we compare taxes by income level across the years?

Just to make it perfectly clear, let’s add some trend lines:

That’s right — not only are taxes decreasing across all income levels, they’re also converging. In 1997 the difference between the lowest tax payed and the highest tax payed was 4.6 percentage points. In 2009, the difference was 3.1 percentage points. That is to say, the difference between taxes payed as a percentage of income has compressed by 32.6%. At this rate, it won’t be very long at all before the U.S. is effectively on a flat tax. In fact, with only a 3% difference between those making $25k and those making $150k, you might as well call it a flat tax now.

I’m not going to make any political arguments about whether or not a flat tax is a good idea. However, given that we’re rapidly approaching the point of having an effectively flat tax rate, it’s at least worth investigating the question of whether all of the tax code complexity at the local, state, and national level is generating sufficient benefit to justify the societal cost of the 100s of thousands of people dedicated to nothing other than tax collection within government at the various levels. The complexities of the tax code are there to drive certain behaviours — whether those behaviours be to get married or not, to quit smoking, to grow corn instead of sugar cane, or whatever other thing we value as a society. But let’s not understate it. When I say, “complexities”, I mean complexities. According to the US Government Printing Office, Title 26 (the part of the US Federal law and regulations dedicated just to income tax) runs to 16,845 pages.

While the burden of complying with all those words has been calculated in different ways, [National Taxpayer Advocate Nina E.] Olson multiplied the IRS’ own estimates of how much time taxpayers spend collecting data for and filling out each individual tax form by the number of forms filed to estimate that Americans (both individuals and businesses) spend 6.1 billion hours a year complying with the code.

And, of course, that’s just the Federal code. I’ll leave it as an exercise for the reader to decide if that’s a good use of societal wealth, or, you know, maybe we could just have an 8.5% state income tax, 6.5% Federal income tax, and 7.5% social security tax … since that’s what we seem to be doing anyhow.

That’s a decent look at the middle class. On the next page, I’ll take a look at the rich.

Chris,

This was a great post, informative and interesting. I have a few thoughts that perhaps you or someone else could comment on:

First, regarding the taxes paid by the wealthy (i.e. “top 1%”), many people combat the notion that the wealthy are being disproportionately taxed by invoking the law of diminishing (marginal) utility. That is, while the wealthy may be paying a considerably greater percent of their incomes in taxes than the less affluent, they, the wealthy, still have a ton of money laying around and the taxes paid, despite being numerically larger, are worth about the same when adjusted for utility. Inherently, this makes some sense to me in that I may more desperately need that X percent of my income if I make $20,000 per year rather than $200,000 or $2,000,000. However, a dollar is always worth a dollar and any concept of utility seems too subjective to be helpful on this scale. What are your thoughts on this?

Second, you made an excellent point on the costs associated with complying with our über-complex tax code. The cost alone is enough to justify considering alternate systems (flat tax, fair tax, etc.). But, how do we, the US, relate to comparable countries in regards to tax complexity? A quick skim of the World Bank Ease of Doing Business Rankings is informative for some glimpse at corporate taxes, however it was relatively unhelpful in yielding information on personal tax complexity. I would be especially interested to see which tax systems have stimulated the most growth.

Third, I am curious about the connection between our total tax burden and the inference that we have the ability to tax more yet still grow our GDP per capita. It is obvious that other countries are able to tax more and maintain a higher GDP per capita than us (or, as your rightly pointed out, raise their GPD per capita faster than us despite higher taxes), but I wonder if suggesting that ‘because other countries have done it, we can too’ may be a too simple an answer. I am certainly no expert in macroeconomics, but some of the countries that managed this feat (like Luxembourg, Switzerland and the Netherlands) are working with a significantly smaller populations, which, I imagine, could be more readily affected by an influx of businesses than our much larger country – in effect growing GDP despite the “tax burden.” So, the question is how much can we learn from countries like Luxembourg and where do those analogies lose utility?

Anyway, thanks again for the great article!

Best,

Micah

Hey Micah,

Thanks for the great reply and the great questions! I’ll come back to the first and third a little later, but I wanted to just give a quick answer to your second question.

The bottom line is that the U.S. doesn’t have any peers of comparable tax complexity. The closest is the U.K., at 11,500-ish pages is closest. But even there, that’s the entirety of their tax code. The over 16,000 pages I quotes for the U.S. was income tax only, and Federal only. After the U.K., other countries drop off quickly. Canada’s income tax act is over 2,000 pages — but it’s written in two languages at that length! The French weigh in at 1,900 pages. After that, it falls off steeply. Of the countries in which I’ve lived, Germany is pretty big at 141 pages, but that’s for the entire Abgabenordnung (or fiscal code, not just the taxes). The Czech Republic, Russia, and Singapore all have flat(-ish) tax structures these days. Really, it’s almost impossible to compare.

As somewhat of an aside, I suspect part of our tax complexity is due to our age. In Europe (and even in the U.S.), people think of the U.S as a young country. However, the reality is that we’re one of the oldest countries in the world. There are only 3 countries in Africa that predate the 20th Century, and none that predate the 19th. In the Americas, a few date from the 19th Century, but we’re the only one to date from the 18th. In Asia, Thailand dates to 1776, but it’s the only 18th Century country, and the vast majority are 20th Century. In Europe, San Marino dates to 1600, the U.K. dates to 1707, and … that’s it. The U.S. is the fourth oldest country in the world. That gave us a lot more time than anyone else to mess up our tax code.

Once again, thanks for the reply, and I’ll get back to your other two questions as soon as I have a few moments.

Hi Micah,

Coming back to your other questions, regarding the first, I’m not sure I completely buy into the marginal utility argument, at least not from that direction. It depends on what one means by “worth”. Money is an abstraction of saved societal free-time, and the rich (who by definition have acquired large quantities) are capable of doing large things (witness Bill Gates philanthropic efforts, or Sir Richard Brandson’s X Prize). One can argue that these have greater worth to society and are a natural outcome of accumulation of wealth. I would say those dollars are worth more to society, not less. That said, they are certainly worth less to the individual (i.e., you’re correct, those saved dollars are more meaningful to the poor than they are to the rich).

The question ultimately comes down to what a “fair” tax is. As I mentioned, the top 1/2 of Americans pay 98% of the Federal income tax. Digging further into this, the top 10% of Americans pay 45.1% of total taxes. This is higher than any other OECD country (for Germany, the number is 31%; for France the number is 28%). This is true even though France and Germany have much higher marginal tax rates because they also have much higher consumption taxes — and consumption taxes (e.g., sales tax) are regressive.

Regarding your third question, yes, it’s hard if not impossible to compare the U.S. to any other country. There are serious issues with scale, which is why I selected the per capita number. Two other ways we could have compared would have been to look at countries with similar populations, and to look at countries with similar total GDPs. Looking at pure GDP, there’s really no one comparable. At $13.8 trillion in 2009, the U.S. was slightly smaller than the entire E.U., but slightly larger than the 17 country Euro zone, 35% bigger than China, and more than triple the next closest economy (Japan). So, I suppose we could compare to China, but I think even more than in the per capita measures, country specific items other than taxation policy would drive the conclusion. Going back to similar population, it’s slightly better than similar GDP, but not much. In 2009 there were 5 other countries which had the same order of magnitude population as the U.S. (which is to say, in the hundreds of millions): Indonesia, Brazil, the Russian Federation, Japan, and Mexico. I would argue that the only one of those worth comparing is Japan. As it happens, the data isn’t even available for Indonesia, Brazil, or Russia. I’ve put together another chart for Mexico, Japan, and the U.S. here: https://www.cwrichardson.com/images/TaxVPopChart.png and I think you’ll find it no more illuminating than the per capita data.

But again, you’re correct. It takes miles to turn a tanker. Thinking that the sort of economic change that caused the success of Switzerland or Ireland could be effected in the U.S. would indeed be naive. I’ll write a separate post on what I think the policy implications of this data should be; for the moment, my only point was that changing tax policy is not going to have a meaningful economic impact.

Cheers,

Chris

Chris,

For the sake of simplicity, I’m going to respond to both of your replies here.

First, I have to admit that I was one of those people that assumed the US was a fairly newcomer on the country-founding scene, at least in comparison to Europe and parts of Asia as I’m fairly familiar with Sub-Saharan Africa and Latin America. I know that I visited a few bars in Prague that are older than the US, so to learn that we are the fourth oldest country in the world came as a shock.

Being an attorney by training, but not by trade, I can say that our legal system has generated similar levels of relative complexity in all areas of the law when compared to our Southern neighbors. When I’m working on projects in Latin America, it always amazes me how easy it is to maneuver in a civil law setting – most things are fairly well laid out in the code and it is reasonably static by comparison. Though, it has been interesting to watch the evolution of legal systems throughout Latin America as they slowly shift to include more of what we in the States would consider to be a common law approach. Of course, in many respects we’re moving more and more towards a codified legal system, so perhaps we’ll meet in the middle. All of this is to say that maybe “younger” countries will catch up to us in tax complexity as they age or maybe we should consider pursuing the sweeping reforms that many countries enact (seemingly without much trepidation) on a fairly regular basis.

Second, I completely agree with your comments on the marginal utility argument. I particularly like your view on the societal benefits the wealthy can generate. While some may debate whether those benefits are a natural outcome of wealth accumulation, history is filled with corporate tycoons turned philanthropists and I suspect this trend will continue.

Regarding the relative percent of taxes paid by the wealthy, I wonder what the effects of wealth distribution, or the gap between the rich and the average, have on the percent of the population paying the majority of the total taxes by country. That is, does it take a smaller percentage of the population to pay the majority of the taxes in the US because that percent of the population is so much wealthier than the average taxpayer? So, setting aside for a moment the debate on whether the wealthy are paying enough or too much in taxes, can some of the difference between the US and Germany and France, in terms of what percent of taxpayers are paying the majority of the taxes, be accounted for by disparities in the number or magnitude of the wealthy in each country? If so, how significant is this effect?

Third, thank you for your brief analysis of alternate means of comparing the US to other countries. Admittedly, I find all of the comparisons to be fairly unsatisfying though, sadly, I can’t recall enough math or economics to suggest additional means of comparison.

I’m looking forward to your policy implications/recommendations write up. I don’t know where you’re finding the time to work on all of this, but I am thoroughly enjoying it.

Cheers,

Micah

Good stuff! Maybe you should be in politics!

Great write up!

I’m skeptical of the state and local tax numbers. My CA effective tax rate is much less than my Federal effective taxe rate and CA very high state taxes.

I never understood the argument for a flat tax rate vs just eliminating exemptions. Marginal tax rates are pretty simple. People would understand the tax system better if they computed their tax from the marginal tax rate table instead of the precomputed tax tables. (IIRC this is how it was on the original federal tax form.)

I’m not sure if the rich are paying their fair share, at least not rich investors. 15% on long term capital gains is a steal.

Hey David,

Thanks! I’m definitely glad you enjoyed it.

It’s true, I would imagine your effective tax rate in CA is much lower than your effective Federal tax rate (see the first chart on page 1). However, your local and state taxes are still almost certainly higher than your Federal taxes (particularly in CA). When you add your property tax, auto tax, your CA SDI, and most significantly your sales tax, I suspect you would find those add to more than your Federal tax. That said, it’s possible they may not, as the analysis here was for hypothetical families of four, not for any specific individual. Also, the analysis was based on the largest city in each state, and living in LA could be very different than living in San Bernardino.

Regarding the rich paying their fair share, see my reply to Micah — maybe, maybe not. But as to tax policy, I agree. I’m not advocating a flat tax (even if we wanted one, we probably couldn’t implement one, because of state and municipal differences — I may have a flat tax in the Czech Republic, but that’s in part because I don’t pay separate taxes to the state of Bohemia or the city of Prague).

Now that I have excavated all this data, I do intend to come forward with some proper suggestions. In the meantime, I just wanted to point out some immediate things that jumped out of the data: that we have a preposterously complex tax system, given that for the middle class we’re effectively extracting a flat tax; and the rich are paying more than most people probably think they are.

With respect to the specific point of the 15% long term capital gains, I’m not sure. I don’t know if I can extract from anywhere the distribution of sources of income for the wealthy. But capital gains would imply they’ve sold some capital. I imagine that the majority of their income in most years comes from interest and dividends, which would be taxed as income. And in fact, capital gains and capital gains taxes are part of AGI, so both are included (though buried) in the above analysis.

Thanks again for reading and commenting!

Chris